Thursday, 4 October 2018

Sunday, 5 August 2018

Gujarat Mantrimandal Pdf Download Gujarati List

Teachers are great sources of knowledge, prosperity and enlightenment to which anyone can be benefited for whole life. They serve as the real light in everyone’s life as they help students to make their ways in the life. They are the God gifted people in everyone’s life who lead us towards success without any selfishness. Really, we can call them as builders of the dazzling future of our nation through education.

https://lakumstech.blogspot.in

Teacher plays very essential role in the field of education who teaches students very nicely to be a person of good moral and behaviour. They make students academically superb and always encourage to do better in the life. They equip students with lots of knowledge, skills and positive attitudes so that students can never feel lost and go ahead. They help students to get sure about their goals of education through clear vision and ideas. Without teachers in the life one cannot grow mentally, socially and intellectually.

https://lakumstech.blogspot.in

A teacher is a good person who takes very important responsibility of shaping up the lives of young ones and impressionable children. They get great feeling, pride and true joy in their life by teaching their students on the right path. They never do any type of partiality between good or bad students instead they always try to bring bad one on the right path through their lots of efforts. A good teacher is someone who spent their whole life in giving quality education to their students. They push all the students to do their best. They make learning process very interesting as well as creative. Teachers try their best to bring all the students on the right track by motivation them positively towards study. Good teachers leave good impression over their students.

https://lakumstech.blogspot.in

They equip students with lots of knowledge, skills and positive attitudes so that students can never feel lost and go ahead. They help students to get sure about their goals of education through clear vision and ideas. Without teachers in the life one cannot grow mentally, socially and intellectually.

https://lakumstech.blogspot.in

They push all the students to do their best. They make learning process very interesting as well as creative. Teachers try their best to bring all the students on the right track by motivation them positively towards study. Good teachers leave good impression over their students.

Saturday, 14 July 2018

GPSC ADVERTISEMENT FOR 294 CLASS 1 -2 POST

Our site https://lakumstech.blogspot.com

provides information about all types of new jobs, academic news and competitive exam materials in gujarat primary education news and India. From here you can get different jobs. Such as education department gujarat, engineer jobs, diploma candidate jobs, MBA jobs, low job and various other jobs. Our site is famous for the preparation of competitive exams. We provide complete examination material for examination conducted from TET, HIT, TET, Police Examination, Clerk Examination, GPSC Examination, Panchayat Clerical Examination and other Gujarat Levels. Visit every day for the latest offers of various brands and other technology updates.

https://lakumstech.blogspot.com

Tag Line : visit Education Department Gujarat, Gujarat Primary Education News, Gujarat Primary Education, Gujarat Education, gujarat education website ojas online, ojas bharti 2018, ojas talati, ojas Job gujarat, ojas gpsc,ojas call letter download, ojas 2, Employment, Exam, Exams, Fix Pay, G.K, Gas/Electricity, General Knowledge, Gpsc, Grammar, Gseb, Gsrtc, Gtu Classes, Gujcat, Hall Ticket, Health Treatment, Also Answer key, Result, Merit and Selection Lists. We Also Provides GK, All types Most Important Study Materials Related General Knowledge, English Grammar, Gujarati Grammar, Maths, Science,

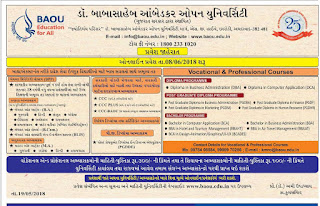

History, Geography, Model Papers, Exams Old Papers, GK In Mp3 And Video Formats For All types COMPETITIVE EXAMS Like TET/TAT/HTAT, GPSC, Talati, Clerk, Police Constable And All Others. Also Good Study materials for Primary, secondary and High Secondary Students. Also Updated Primary School Latest CIRCULAR, Education News Paper News, Mobile, Donate, Admission, Admit Card, Answer Key, Application Form, Attorney, Badli, Bank, Baou, Bisag, Blood, Call letter, Ccc, Circular, Claim, Clerk, Conference Call, Constable, Cpf, Crc, Credit, Current Affair, High-court, Hngu, Hosting, Hsc, Htat, Ibps, Insurance, Iti, Ivrs, Job , Lawyer, Loans, Merit List, Merit, Talati, Tat, Tat, Tat-Htat, Technology Tips ,Tet, Toll Free Number, Trading, Training, Transfer, Unit Test, University, Upsc, Upsc, Mobile, Current Affairs, Degree, Module, Mortgage, Mp3, Neet, Nmms, Notification, Ntse, Offer, Ojas, Paripatra, Pdf File, Poem, Pragna, Pran, Prayer, Primary, Psi, Quiz, Recovery, Requirement, Results, Revenue Talati, Scholarship

SEE Notification 👇👇👇👇👇👇

Tuesday, 10 July 2018

- To conduct examinations for appointment to the services of the State.

- To advise on –

- The matters relating to methods of recruitment to various Civil Services of the State;

- The principles to be followed in making appointments to civil services of the State and granting promotions, transfers from one service to another and the suitability of candidates for such appointments, promotions and transfers;

- All the disciplinary matters affecting the Government servants,

- The claims of reimbursements of legal expenses incurred by Government Servants in defending themselves in legal proceedings initiated against them for the act done or purported to be done by them while executing their duty;

- The claims for granting injury-pensions to Government Servants; and

- Any other matters that may be referred to the Commission by His Execellancy the Governor

List of Eligible Candidates for Interview, Advt. No 58/2017-18,Home Advertisement Details Advt. No. 58/2017-18Lecturer, Prasuti and Striroga,Health and Family Welfare, Class-2

List of Eligible Candidates for Interview, Advt. No 58/2017-18,Home Advertisement Details Advt. No. 58/2017-18Lecturer, Prasuti and Striroga,Health and Family Welfare, Class-2Monday, 25 June 2018

Dear Visitors.. In This Website We Are Daily Updated Latest Gujarat & India Level All Types Government Jobs Like GPSC,Talati, Clerk, Teacher, PSI, Constable, Banks, Engineering Jobs And Other Various Jobs. We also Updated Various Exams schedule, Answer key, Result, Merit and Selection Lists.

In this site Also Updated Primary School Latest CIRCULAR, Education News Paper News, Latest Mobiles, Computer And other Technology Tips & Tricks with Images And Videos.

Sunday, 17 June 2018

Many mutual fund investors have the habit of searching for top 10 mutual fund schemes while investing in mutual funds. Often, they land in sites where mutual fund schemes would be listed on the basis of their performance over a short period. No wonder, many investors keep wondering whether they picked up the right schemes even after investing in them for a few years. That is why ET Mutual Funds decided to come with our own list of Top 10 mutual fund schemes. Unlike other sites, the list is not just a list of 10 schemes in every category based on their short-term returns. We have picked up two schemes from five different categories -- largecap, midcap, multicap, ELSS or tax saving schemes and equity-oriented hybrid schemes - which we believe should be enough for regular mutual fund investors. We believe that the list would be of immense help to new investors looking to invest in mutual funds. Mostly, new investors start with Equity Linked Savings Schemes (ELSSs) or tax saving/mutual fund schemes. Investments in these schemes qualify for tax deductions of up to Rs 1.5 lakh under Section 80C of the Income Tax Act. These schemes are ideal for new investors as they come with a mandatory lock-in period of three years and it helps investors tackle volatility typically associated with equity mutual funds. Equity-oriented hybrid schemes or balanced schemes are also ideal for novices to the stock market. These schemes invest in a mix of equity (minimum 65 per cent) and debt, and they are relatively less volatile than pure equity schemes that invest the entire corpus in stocks. Equity-oriented hybrid schemes are the best investment vehicle for investors looking to create long-term wealth without much volatility. A regular investor looking to invest in the stock market need not look beyond mutlicap mutual funds or diversified equity schemes. These schemes invest across market capitalisation based on the view of the fund manager. They invest mostly in largecap and midcap stocks, with a small allocation to smallcap stocks. A regular investor can benefit from the uptrend in any of the sectors, categories of stocks by investing in these schemes.

Some investors want to play extremely safe even while investing in stocks. Largecap schemes are meant for such individuals. These schemes invest in top 100 stocks and they are relatively safer than other stocks. They are also relatively less volatile than midcap and smallcap schemes. In short, you should invest in largecap schemes if you are looking for modest returns with relative stability.

What about aggressive investors looking to take extra returns by taking extra risk? Well, they can bet on midcap schemes that invest mostly in medium sized companies. These schemes can be a bit volatile, but they also have the potential to offer superior returns over a long period. You can invest in midcap schemes if you have a long-term investment horizon and an appetite for higher risk.

See Images 👇👇👇👇

Sunday, 3 June 2018

UPSC Recruitment 2018: New posts announced at upsconline.nic.in; check how to apply

UPSC Recruitment 2018: The candidates looking to apply for these posts may do so on or before June 15.By UPSC Recruitment 2018: The commission is looking to fill up a number of posts. (IE)

UPSC Recruitment 2018: The Union Public Service Commission or UPSC has issued a notification on recruitment for 65 posts of assistant professors (specialists and others). The candidates looking to apply for these posts may do so on or before June 15 at commissions official website – https://www.upsconline.nic.in. The commission has also announced an important update for all Central Armed Police Forces (Asstt. Commandants) 2018 candidates. In a letter signed by the under secretary, the Commission has listed names of aspirants whose applications have been rejected due to the non-payment of Exam fee.

It has stated that application fee confirmation of some candidates ‘has NOT been received from the Bank Authorities.’ Candidates applying for above said posts were supposed to submit a Fee of Rs. 200/- in respect to the CAPF (ACs) Examination, 2018.

More details about new vacancies:

Below is a list of post that the UPSC is looking to fill up:

Assistant Professor (Paediatrics): 14 Posts

Assistant Professor (Nephrology): 12 Posts

Assistant Professor (UNANI): 02 Posts

Assistant Professor (UNANI): 02 Posts

Assistant Professor (UNANI): 01 Post

Assistant Professor (UNANI): 01 Post

Assistant Professor (UNANI): 01 Post

Assistant Professor (UNANI): 02 Posts

Assistant Professor (UNANI): 02 Posts

Assistant Professor (UNANI): 01 Post

Senior Design Officer: 02 Posts

Director: 01 Post

Lecturer (Printing Technology): 05 Posts

Lecturer (Computer Engineering): 12 Posts

Lecturer (Electrical Engineering): 05 Posts

Lecturer (Electronics with specialization in Medical Electronics): 02 Posts

Qualification:

Director: Those looking to apply for this post, must have bachelor’s degree in Veterinary Science or Bachelor’s Degree in Veterinary Science and Animal Husbandry as suggested in the First or Second Schedule of the Indian Veterinary Council Act.

Senior Design Officer: Candidates applying for this post must have a degree in Mechanical/Marine Engineering from any university recognised by the government or equivalent.

Assistant Professor: The person must have MBBS degree as has been suggested in the First Schedule or Second Schedule or Part II of the Third Schedule (other than licentiate qualifications) in the Indian Medical Council Act, 1956 ( 102 of 1956).

Assistant Professor (UNANI): Candidates looking to apply for this post must have a degree in Unani Medicine from a University established by Law or a Statutory Board/Faculty/ Examining Body of Indian Medicine or equivalent as recognised under Indian Medicine Central Council Act, 1970. Candidates must also have a Post Graduate Degree in the subject/specialty concerned that is included in the Schedule to the Indian Medicine Central Council Act, 1970.

Lecturer: Those looking to apply for this post must have bachelor’s degree in Engineering/Technology in the Engineering/Information Technology and Computer Science with first class or equivalent from any recognised University/Institute. In case a candidate has a Master’s degree in Engineering or Technology, First class or equivalent is needed at Bachelor’s or Master’s level.

How to Apply

Candidates may apply online against this advertisement at the

Wednesday, 30 May 2018

SPIPA Entrance Test for IBPS, RBI, SBI, LIC, SSC, RRB and Other Competitive Exams Training 2018-19

Many mutual fund investors have the habit of searching for top 10 mutual fund schemes while investing in mutual funds. Often, they land in sites where mutual fund schemes would be listed on the basis of their performance over a short period. No wonder, many investors keep wondering whether they picked up the right schemes even after investing in them for a few years. That is why ET Mutual Funds decided to come with our own list of Top 10 mutual fund schemes. Unlike other sites, the list is not just a list of 10 schemes in every category based on their short-term returns. We have picked up two schemes from five different categories -- largecap, midcap, multicap, ELSS or tax saving schemes and equity-oriented hybrid schemes - which we believe should be enough for regular mutual fund investors. We believe that the list would be of immense help to new investors looking to invest in mutual funds. Mostly, new investors start with Equity Linked Savings Schemes (ELSSs) or tax saving/mutual fund schemes. Investments in these schemes qualify for tax deductions of up to Rs 1.5 lakh under Section 80C of the Income Tax Act. These schemes are ideal for new investors as they come with a mandatory lock-in period of three years and it helps investors tackle volatility typically associated with equity mutual funds. Equity-oriented hybrid schemes or balanced schemes are also ideal for novices to the stock market. These schemes invest in a mix of equity (minimum 65 per cent) and debt, and they are relatively less volatile than pure equity schemes that invest the entire corpus in stocks. Equity-oriented hybrid schemes are the best investment vehicle for investors looking to create long-term wealth without much volatility. A regular investor looking to invest in the stock market need not look beyond mutlicap mutual funds or diversified equity schemes. These schemes invest across market capitalisation based on the view of the fund manager. They invest mostly in largecap and midcap stocks, with a small allocation to smallcap stocks. A regular investor can benefit from the uptrend in any of the sectors, categories of stocks by investing in these schemes.

Some investors want to play extremely safe even while investing in stocks. Largecap schemes are meant for such individuals. These schemes invest in top 100 stocks and they are relatively safer than other stocks. They are also relatively less volatile than midcap and smallcap schemes. In short, you should invest in largecap schemes if you are looking for modest returns with relative stability.

What about aggressive investors looking to take extra returns by taking extra risk? Well, they can bet on midcap schemes that invest mostly in medium sized companies. These schemes can be a bit volatile, but they also have the potential to offer superior returns over a long period. You can invest in midcap schemes if you have a long-term investment horizon and an appetite for higher risk.

Notification. Apply online